Wilmington DE Real Estate: Remodeling Projects That Pay Off and Boost Your Home Value

While the winter season has been named one of the best times to sell your Wilmington, DE home, many homeowners are taking to remodeling instead. Home projects, when planned correctly and according to the real estate market, can boost your home value and pay off when you decide to sell.

While the winter season has been named one of the best times to sell your Wilmington, DE home, many homeowners are taking to remodeling instead. Home projects, when planned correctly and according to the real estate market, can boost your home value and pay off when you decide to sell.

So whether you're simply ready to upgrade your kitchen or bring up the value of your home in Wilmington or Newark, keep in mind the following projects that have the highest return on investment (ROI) at resale:

Your front door

Year after year, replacing the front door continues to provide one of the healthiest returns on investment for Delaware homeowners. Replacing your current door with a steel door can average up to 98 percent ROI— the highest return when looking at Remodeling Magazine's Cost vs. Value Report.

In addition, replacing your front door is one of the least expensive projects in the report, coming in at an average of $1,230. It requires little maintenance and can even qualify as an energy upgrade depending on the door you choose.

The siding

Next in terms of ROI is replacement siding. Swapping out the siding on your Wilmington area home can recoup you as much as 84 percent at resale. In fact, by keeping your old, worn-down siding, you could assume a loss of 10 percent on your home's value.

Just by looking at the Top 10 Projects for Long-term ROI in the Cost vs. Value Report, you will notice three of them are related to siding. New siding is also the one home improvement project that does wonders for your curb appeal— important if you're considering selling your home in the near future.

Kitchen upgrades

There is no need to do a complete kitchen overhaul this year— these types of renovations took a hit in terms of ROI in recent years. Minor kitchen upgrades including new cabinets, countertops, flooring and appliances can recoup you an average of 82 percent. The Cost vs. Value Report suggests an investment of $19,000, including labor, to make these changes and notice the benefits at resale.

The deck or patio

More homebuyers in recent years have expressed a desire for outdoor space. Decks are coming back around in terms of ROI and even beating out bathroom remodels. One reason decks and patios are a smart investment this year is the low cost— ranging anywhere from $8 to $30 per square foot. Adding a wooden deck addition to your Wilmington home could bring an ROI of 80 percent.

As your local New Castle County real estate experts, the KG Home Team knows what homebuyers are looking for and where your money would best be invested if you're looking to sell. Contact us today to get an idea of your home value and where the property could benefit from renovations.

----

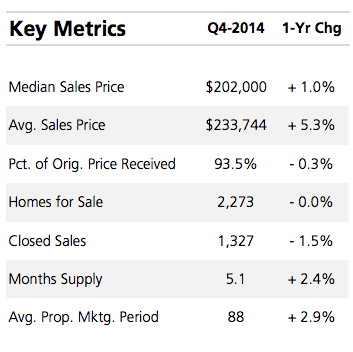

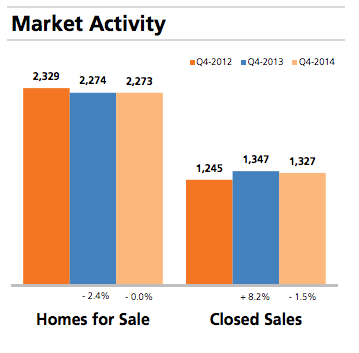

Over the past year, real estate has been heading in the right direction and both buyers and sellers are beginning to notice. In fact, for the first time in 9 years, Americans have a positive view of real estate as a whole.

It is this growing confidence on both sides of the fence—homebuyers and home sellers— that will contribute to a busy year for the Wilmington DE market. Do not hesitate to get started if you're serious about buying or selling this year as waiting even just a few months could cost you more money in the long run!

Katina Geralis

Wilmington, DE Real Estate Expert

Keller Williams Realty

Wilmington Real Estate

Wilmington Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

Now that the weather has turned colder,

Now that the weather has turned colder, .png)

It's a new year and that means new goals for many

It's a new year and that means new goals for many  2015 is already being called the "Year of the

2015 is already being called the "Year of the  First-time homebuyers

First-time homebuyers

According to new research from RealtyTrac, saving enough money for a

According to new research from RealtyTrac, saving enough money for a

The

The