5 Reasons Buying a Delaware or Pennsylvania Home Is Better Than Renting

Before you renew your lease or consider signing a new one, you might like to consider buying a home in Delaware or Pennsylvania. There are dozens of reasons why homeownership is the better option over renting and as your local real estate experts, we've included a few of them for you below!

Before you renew your lease or consider signing a new one, you might like to consider buying a home in Delaware or Pennsylvania. There are dozens of reasons why homeownership is the better option over renting and as your local real estate experts, we've included a few of them for you below!

It's less expensive

While you may be intimidated by homeownership, you will be glad to know it is much less expensive than renting! According to a new report, it is now 37 percent less expensive to buy a home than it is to rent nationwide. If you're ready to take that next step toward buying your own home, your first step is to meet with a lender to get pre-approved and find out how much you can afford!

You can lock in your housing cost

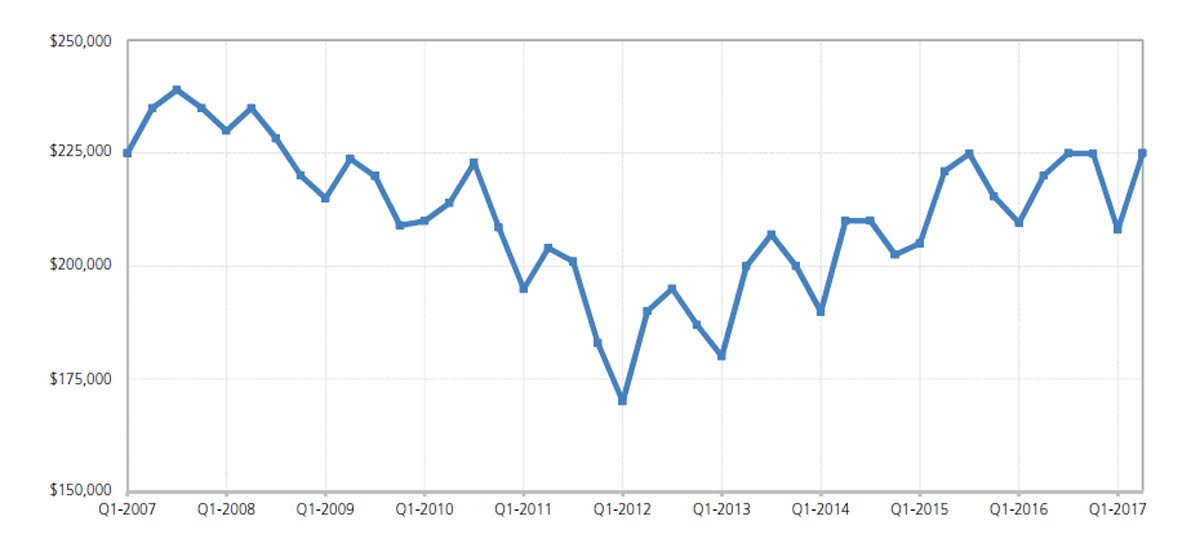

The costs of renting are always rising, but with homeownership, you are able to lock in your housing costs for the next 5, 10, 15, even 30 years, depending on the mortgage you choose! Locking in one of the current interest rates, which are currently hovering around historic lows, allows you to watch your home value rise, but your housing costs stay the same!

There are tax advantages

When you own your own Delaware or Pennsylvania home, there are certain tax benefits that come along with it. For instance, did you know you can deduct the cost of property taxes and mortgage interest from your annual taxes? It's always best to check with your account to see which advantages apply to you, but owning a home is certainly a way to earn tax savings!

Homeownership is forced savings

Think of owning a home in Southeastern PA or Greater Wilmington DE as a means of "forced savings." What that means is that by simply paying your mortgage each month, you are building equity that you can use at a later date toward renovations, paying down debt, or whatever you choose. When you rent a home, that savings is all funneled to your landlord.

It's the best investment

Homeownership has long been hailed as one of the best investments you can make— better than stocks or gold! What's more, no other investment allows you to live in it! When you purchase a home, not only are you helping to build your wealth with the investment, but this one also allows you a place to live! You can't say the same for gold.

Ready to find a place of your own in the Greater Wilmington DE or Southeastern PA area? Do not hesitate to contact the Kat Geralis Home Team with any questions about buying a home in Delaware or Pennsylvania this year or for a list of available properties! We even offer FREE First-Time Home Buyer Seminars!

We look forward to hearing from you!

Katina Geralis

DE and PA Real Estate Expert

eXp Realty

Wilmington Real Estate

Wilmington Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

When you decide to

When you decide to  As you may have heard by now, the

As you may have heard by now, the  Did you know the majority of today's

Did you know the majority of today's  September is here and it's time to start getting your home ready for the fall season ahead. Say goodbye to summer by putting away garden tools, patio furniture and cleaning the gutters to make way for the falling leaves.

September is here and it's time to start getting your home ready for the fall season ahead. Say goodbye to summer by putting away garden tools, patio furniture and cleaning the gutters to make way for the falling leaves.

It is no secret that mortgage rates won't be this low forever and as a result, many

It is no secret that mortgage rates won't be this low forever and as a result, many  As a

As a  In a

In a  Spring has sprung and as you read this, dozens of

Spring has sprung and as you read this, dozens of