Updated! New Castle County DE Real Estate Market Stats

Now that spring has arrived, many homeowners and potential homebuyers are wondering if now is the right time to make a move. The KG Home Team is always happy to provide information about the local real estate market, including these updated market statistics for New Castle County Delaware!

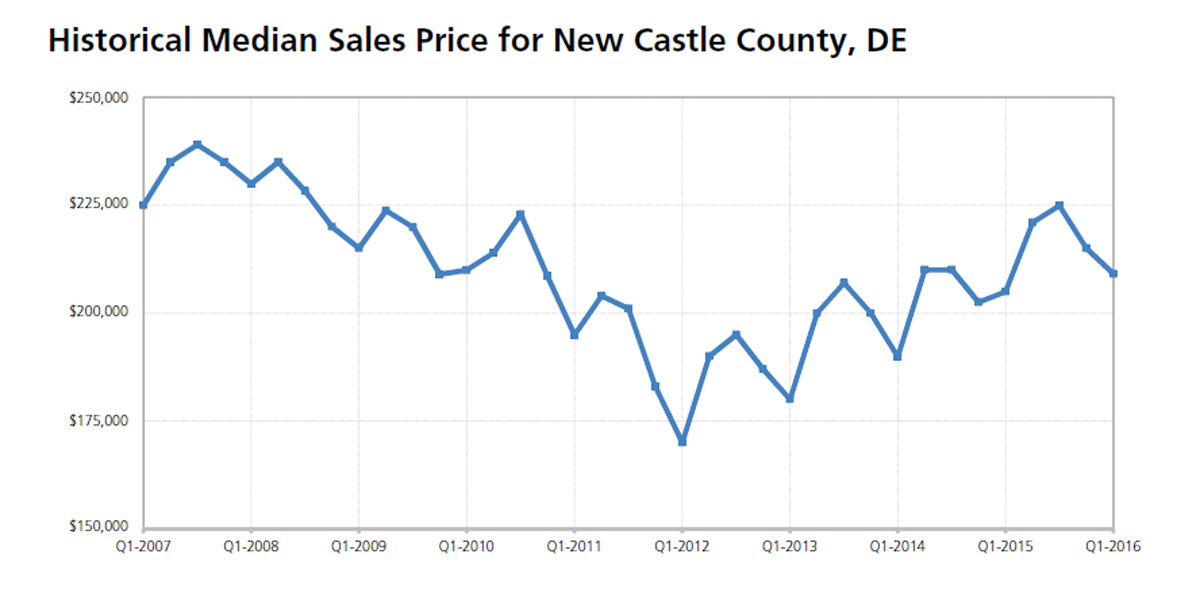

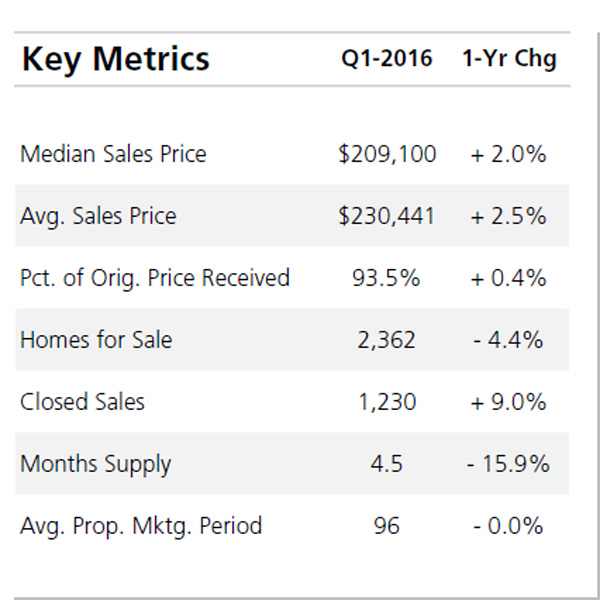

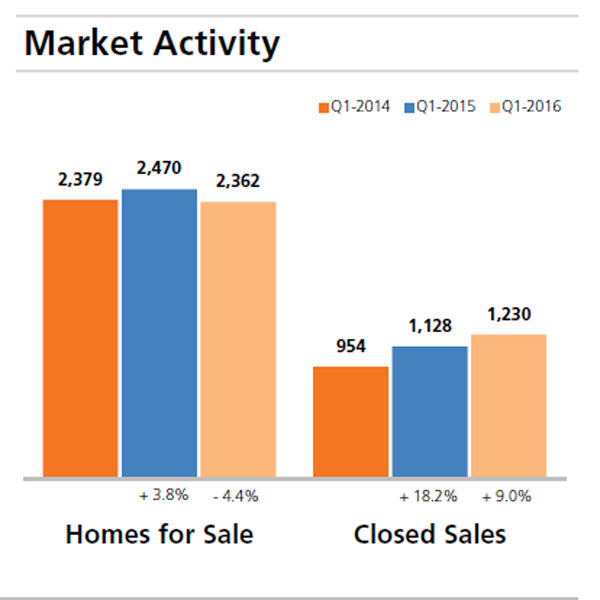

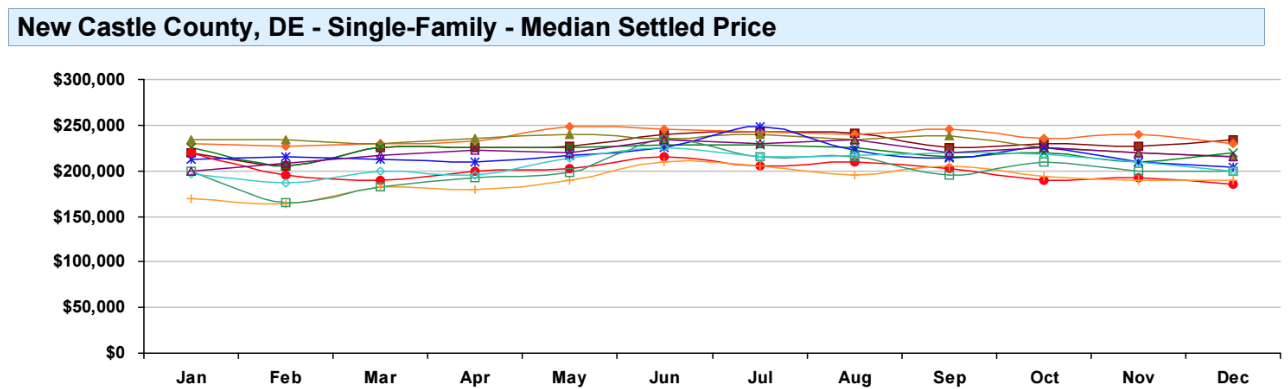

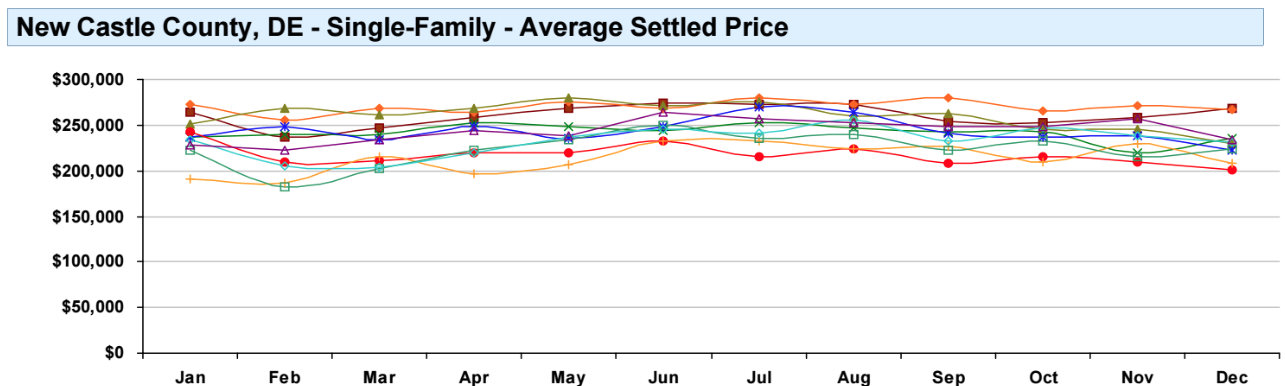

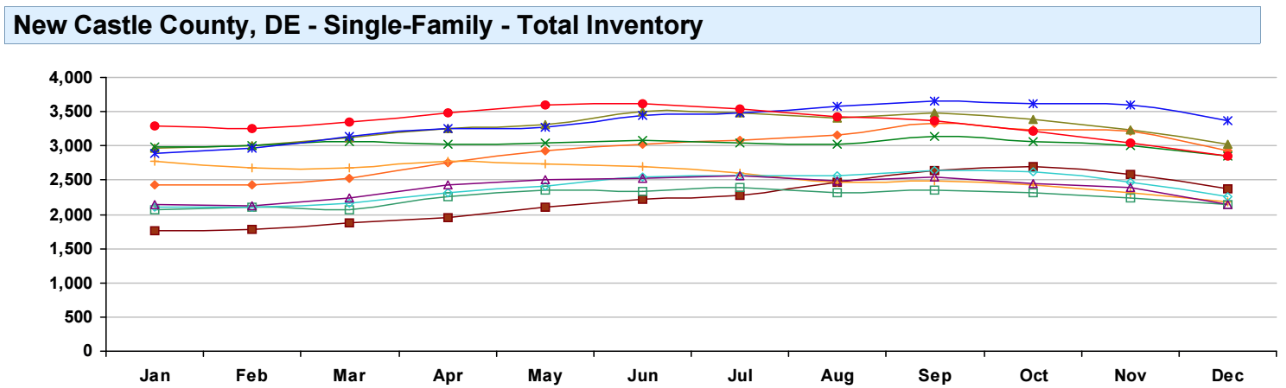

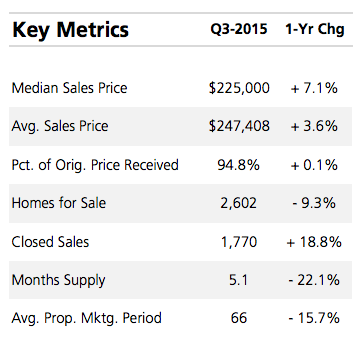

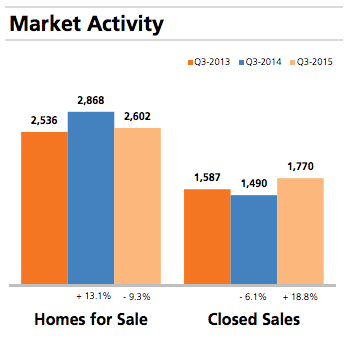

For the first quarter of 2016, there were 2,362 homes for sale— a 4.4 percent decrease in inventory from this time last year. And while New Castle County is indeed experiencing the low inventory that can be found throughout much of the country right now, both the sales prices of homes in the area and the number of closed sales are up from 2015!

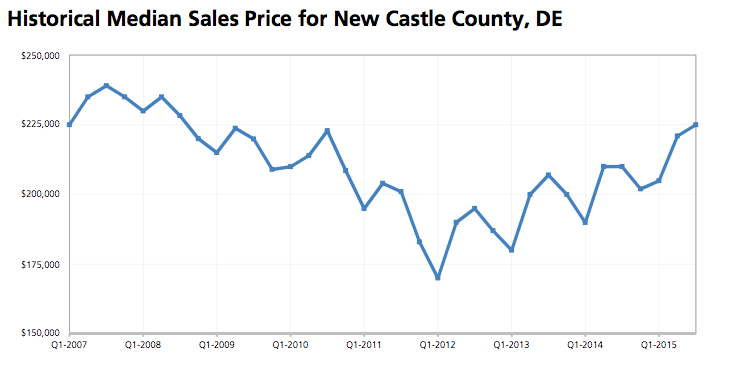

The average sales price for the first quarter of 2016 was $230,441—up 2.5 percent from last year—and the number of closed sales totaled 1,230— up 9 percent from last year! Home sellers in New Castle County DE were also reported to have received 93.5 percent of the original price at closing, which is an increase of .4 percent from 2015!

As you can see from the infographics above, buyer demand is high despite the lack of inventory in the local market; the first quarter is showing inventory at a 4.5 months supply, 15.9 percent lower than last year's inventory during the same time.

It is a great time to be a home seller in Greater Wilmington and Southeastern PA, with sales prices and closed sales increasing, in addition to a great time for buyers with mortgage rates still at historic lows! Remember, these updated statistics provide a brief snapshot of levels in the local real estate market, so do not hesitate to contact the KG Home Team with any questions about homes for sale in the area!

Our top-notch agents are here to help with any of your needs this year, from finding your dream home in Delaware or Pennsylvania to selling your current property! We look forward to hearing from you!

Katina Geralis

Wilmington, DE Real Estate Expert

Keller Williams Realty

Wilmington Real Estate

Wilmington Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

Homebuyers

Homebuyers

When it comes to

When it comes to

According to the latest Housing Opportunities and Market Experience (HOME) survey from the National Association of REALTORS, 94 percent of

According to the latest Housing Opportunities and Market Experience (HOME) survey from the National Association of REALTORS, 94 percent of  The holiday season is upon us! In just two short weeks,

The holiday season is upon us! In just two short weeks,

For

For