How to Get Ahead of the Spring Delaware, Pennsylvania Real Estate Market

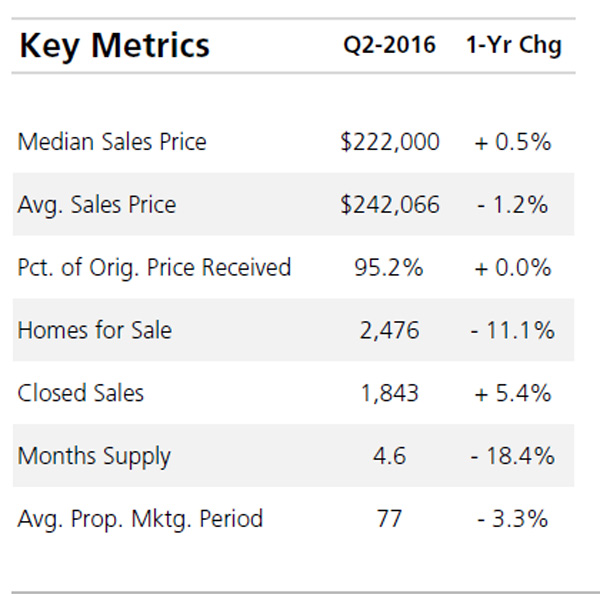

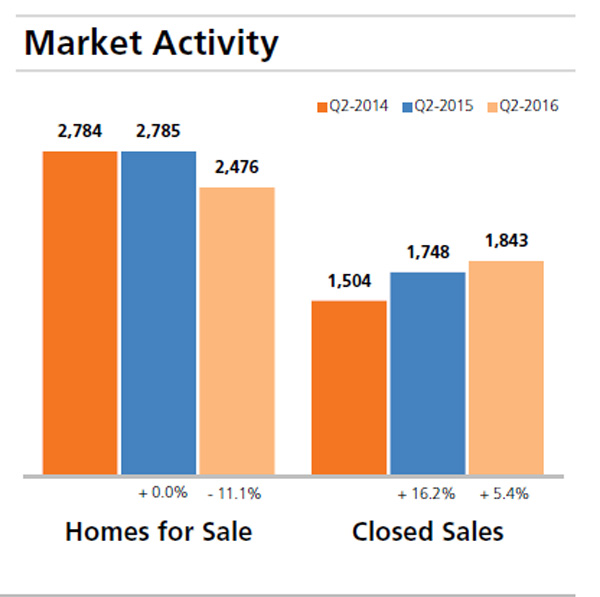

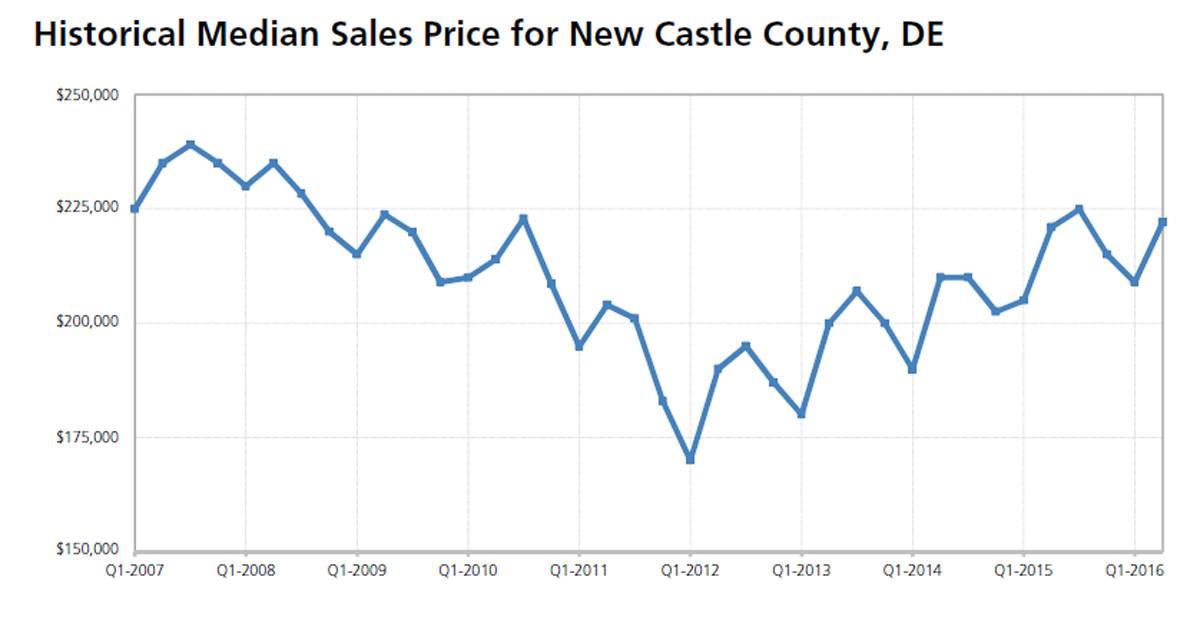

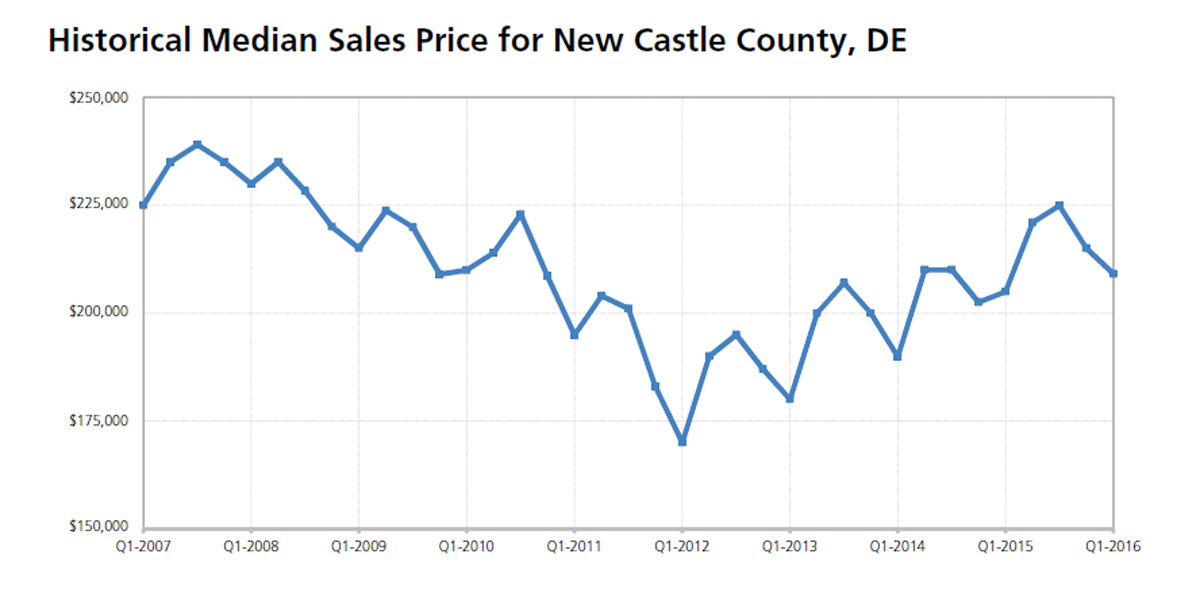

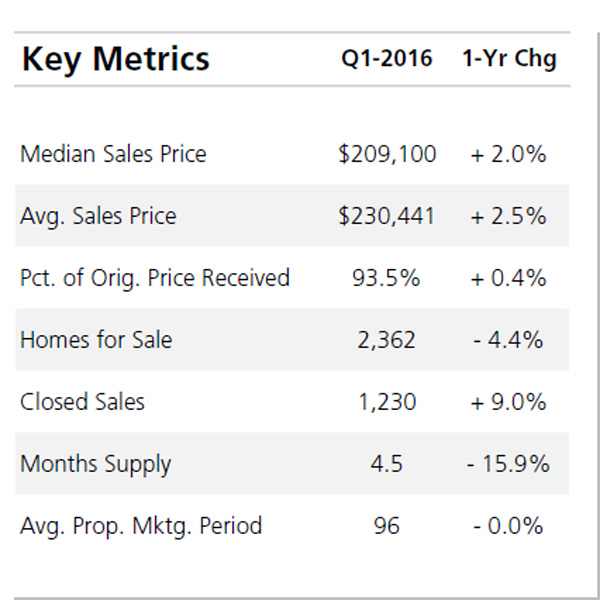

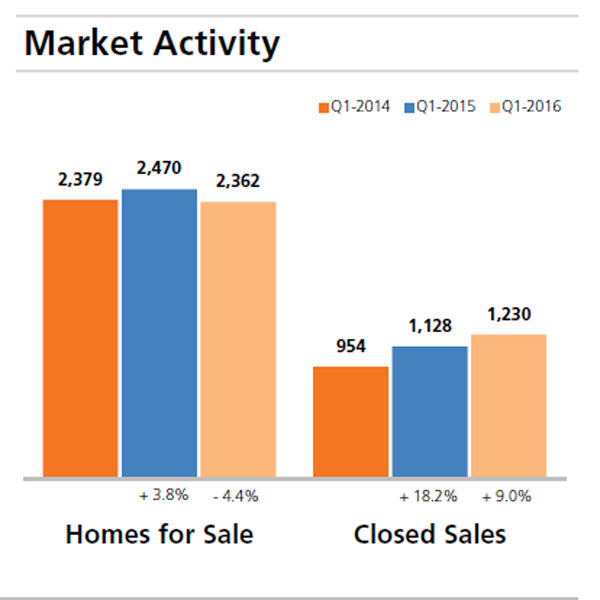

The busy spring real estate season is just around the corner in Greater Wilmington and Southeastern Pennsylvania and soon a wave of potential buyers will take to searching for their perfect property. Not only do the increased temperatures play a role in getting buyers out and about to tour homes for sale, but lower inventory this season is giving sellers the edge they need to earn top dollar.

The busy spring real estate season is just around the corner in Greater Wilmington and Southeastern Pennsylvania and soon a wave of potential buyers will take to searching for their perfect property. Not only do the increased temperatures play a role in getting buyers out and about to tour homes for sale, but lower inventory this season is giving sellers the edge they need to earn top dollar.

But that doesn't always mean your Delaware or Pennsylvania home is ready for buyers to step inside and prepare their offers. You may need to do a bit of prep work before you're officially in the game! Below are four ways to get ahead of the spring real estate market this year and make your home stand out from the rest in Chester County and Delaware County PA as well as the Newark and Wilmington DE areas.

Make repairs

One way your Greater Wilmington area home can rise to the top of buyer wish lists this spring is by being up to date on repairs. You may wish to get a home inspection prior to listing which will help you identify any problems, but if you know now that faucet needs fixing, now is the time to do so!

Boost curb appeal

How does your home stack up to others for sale from the outside? Landscaping can do wonders in the eyes of buyers, even if it's just planting flowers around your entryway or sprucing up garden beds with fresh mulch. Any hedges or shrubs that may have grown unruly over the winter should be tended to as well.

Kick the clutter

Once you've wowed buyers from the outside, you will want to do the same inside. Walk around your home, careful to observe any interruptions in the flow from room to room. Do you have to sidestep furniture? Remove it or relocate it! Do you have excess knick knacks that take away from showing the true beauty of the property? Put them away while your home is listed.

Brush up on your finances

Do you know how you will respond to offers? Do you have realistic expectations in terms of how much you want to sell your Delaware or Pennsylvania home for? Before you are ready to dive into the market head first, you will want to have a plan in place so you don't experience seller's remorse later.

You can count on the Kat Geralis Home Team to guide you through the spring market this year! Whether you're ready to list now or have questions to clear up first, we're here to help you every step of the way.

Give us a call today!

Katina Geralis

DE and PA Real Estate Expert

eXp Realty

Wilmington Real Estate

Wilmington Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

The idea of cutting your

The idea of cutting your  No matter if you live in

No matter if you live in  It is not uncommon for

It is not uncommon for

Buying a home in

Buying a home in  For those gearing up to

For those gearing up to

Homebuyers

Homebuyers