Updated: Q1 Delaware and And Pennsylvania Real Estate Market Stats 2020

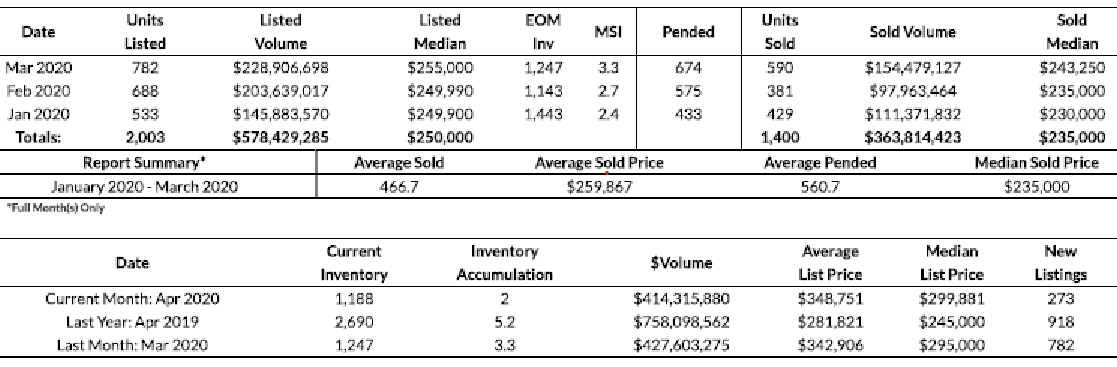

The Delaware and Pennsylvania real estate market began 2020 with good momentum. From January through March 2020, a total of 1,400 homes were sold. March posted the highest activity of the quarter with 590 homes sold within the month.

Median home prices climbed on a month-over-month basis, reaching $243,250 during March 2020. "Median" indicates that half of the homes sold for more than this amount, and half of them sold for less.

When we consider the sale prices of all properties sold during the first quarter of 2020, we have an average sold price of $259,867. This is slightly less than the average sold price during the forth quarter of 2019, which was $264,505.

Home inventory grew during the first quarter, with 2,003 new listings arriving on the market. Home buyers were ready and waiting! Properties spent an average of 51 days on market, which is a brisk pace by historical norms.

There are some variables to keep in mind during the second quarter of 2020. On the positive, mortgage interest rates are cheap, with 30-year fixed-rate mortgages averaging around 3.33% for borrowers with excellent credit. (Source: FreddieMac weekly PMMS survey.)

Yet the changing economic climate could slow our market activity. Employment uncertainties, a turbulent stock market and stricter mortgage underwriting could reduce the pool of ready buyers. We may see this play out in longer days-on-market, and a leveling off of home price appreciation.

We have had limited home inventory for some time in Delaware and Pennsylvania, which will help support home prices for a while. Home buyers and home sellers should prepare for changing market conditions, and work closely with their agents to stay informed about sales trends.

Questions about buying or selling a home? Contact the Kat Geralis Home Team today!

Katina Geralis

DE and PA Real Estate Expert

eXp Realty

Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

The spring home buying season isn’t going to be easy for

The spring home buying season isn’t going to be easy for