Nearly All Young Renters in Wilmington DE Want to Purchase A Home

According to the latest Housing Opportunities and Market Experience (HOME) survey from the National Association of REALTORS, 94 percent of renters aged 34 and younger want to own a home in the future. Not only does this take into account their beliefs on whether or not now is a good time to buy or sell and their expectations of the mortgage market, but also their beliefs on homeownership as part of the American Dream.

According to the latest Housing Opportunities and Market Experience (HOME) survey from the National Association of REALTORS, 94 percent of renters aged 34 and younger want to own a home in the future. Not only does this take into account their beliefs on whether or not now is a good time to buy or sell and their expectations of the mortgage market, but also their beliefs on homeownership as part of the American Dream.

The survey also found that indeed 77 percent of renters believe homeownership is part of their American Dream, 83 percent of overall renters (not just young renters) want to own a home in the near future and 84 percent of renters believe owning a home is a good financial decision.

So what does that mean for you if you are among the majority of Wilmington Delaware renters who are dreaming of owning a home in the coming year? We've rounded up a few tips below to help you prepare to become a homeowner:

Start saving your down payment

We have shared in a past blog post various ways to begin saving for a down payment, from setting up an automatic withdrawal from your account each month to cutting back on large purchases to downsizing your current apartment to save the difference for your future home. Either way—and no matter how much you intend to put down—you need to start putting money away for this purpose.

The survey found that one of the top reasons young renters do not currently own was the inability to afford it. With the rising costs of rent, it may be easier for you to save for your future home by downsizing in the meantime!

Clean up your credit score

Errors on credit reports can take months to correct, but bad credit can take even longer. Start grooming your credit well in advance of applying for a mortgage and you will be that much closer to a speedy approval! Wilmington area buyers can begin by ensuring all payments are made on time and in full, paying down any large debt and keeping credit card purchases to a minimum.

Remember, you do not need the best score to purchase a home, but the higher you can get it, the better the interest rate you will be able to secure.

Make a budget

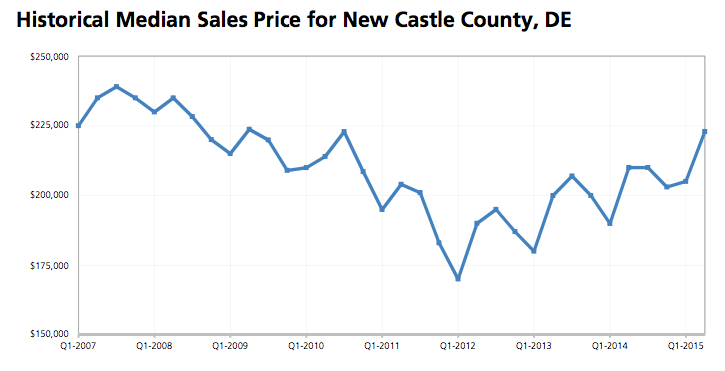

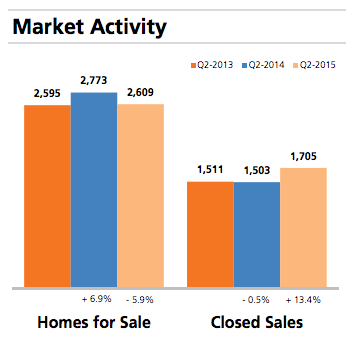

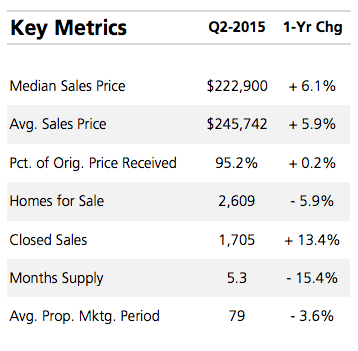

To better prepare yourself for buying a home, it is wise to start researching home prices in your desired area of Wilmington. Do you know what neighborhood you'd like to live in? How about your wants and needs in a home? Once you have these in mind, you can enter your monthly income and costs into a mortgage calculator to see if your dream home is within reach. If not, you can adjust your budget, but it is always helpful to have a price range in mind as you begin the homebuying journey!

Buying a home in Wilmington, DE is a big step, especially if it's your first time! But don't worry— the KG Home Team has consistently been ranked a Top Real Estate Team in Delaware and we are here to help you with every decision along the way!

We even offer FREE First-time Homebuyer Seminars and a FREE Home Buyer E-Guide!

Katina Geralis

Wilmington, DE Real Estate Expert

Keller Williams Realty

Wilmington Real Estate

Wilmington Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

For

For

In a

In a  Did you know Millennials (the age group of those born between 1980 and 1995) love working with

Did you know Millennials (the age group of those born between 1980 and 1995) love working with

Summer is a busy time in the real estate market, with

Summer is a busy time in the real estate market, with  Recent reports have shown more

Recent reports have shown more  As more

As more