Buying a Wilmington, DE Home— Act Quickly!

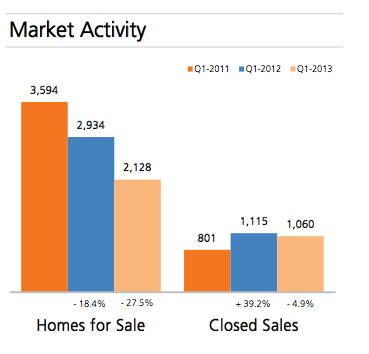

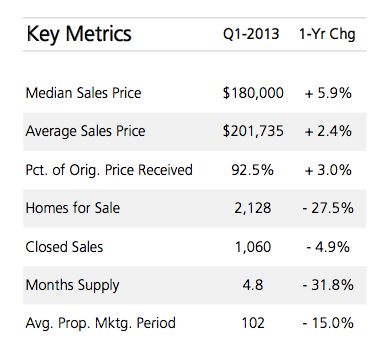

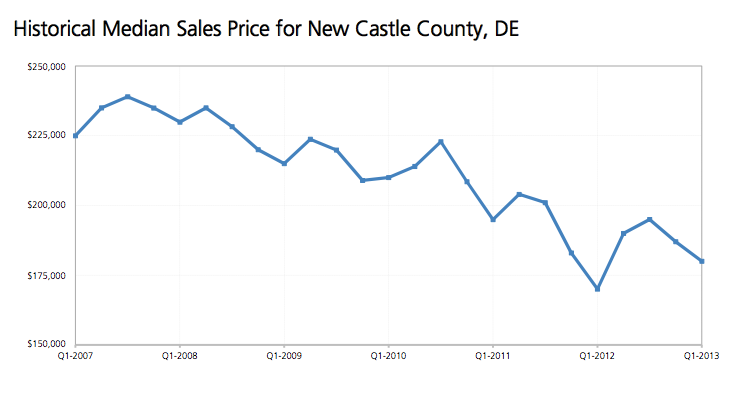

While housing inventory across the country is beginning to increase— along with mortage rates, housing prices, and buyer confidence— Wilmington, DE homebuyers are urged to act quickly if purchasing a home in the area is something in their near future. You've started your home search and you think you've found the perfect home, but are hestitating to make the jump to finalize all of the real estate plans. Don't think twice! Homes are beginning to sell quickly on the local real estate market and homebuyers will need to respond and be decisive if they wish to secure their dream home purchase.

While housing inventory across the country is beginning to increase— along with mortage rates, housing prices, and buyer confidence— Wilmington, DE homebuyers are urged to act quickly if purchasing a home in the area is something in their near future. You've started your home search and you think you've found the perfect home, but are hestitating to make the jump to finalize all of the real estate plans. Don't think twice! Homes are beginning to sell quickly on the local real estate market and homebuyers will need to respond and be decisive if they wish to secure their dream home purchase.

Cash offers are becoming more apparent and lender standards are starting to loosen. According to data from the National Association of REALTORS®, in May, 45 percent of all homes sold were on the market for less than a month. So what can you do as a Delaware homebuyer to act quickly and land your dream home? Here are some tips to start the process:

1. Get preapproved, not just prequalified

Getting preapproved for your Wilmington home's mortgage helps to show the seller that the buyer is serious about this home purchase and has a greater likelihood of being approved for a loan and making it to closing.

2. Be responsive to your lender

If a lender asks for more information, be ready to respond. When you are willing and able to provide everything the lender requests, you should have no problems making it to your closing within a month, pending the title company and others involved work within your time frame as well.

3. Be decisive, not careless

It's important that you as a homebuyer are decisive in what you want and need out of your future home, but do not act on a whim to purchase quickly. Experts still advise that no matter how much of a hurry you are in, you should still set your sale contingent upon a home inspection. Afterall, you may love the home but you don't want to get stuck with a problematic one after the sale.

Are you ready to take a look at the area homes for sale and invest in your piece of Wilmington, DE real estate? Let me help you decide which type of property best fits your needs for homeownership. Together we will work to find the best home for both you and your family. You can also learn more about the buying process at our FREE first-time home buyer seminars!

As always, feel welcome to contact me for more information about homes for sale in Wilmington and Newark. I am here to help you with your home ownership goals!

Katina Geralis

Wilmington, DE Real Estate Expert

Keller Williams Realty

Wilmington Real Estate

Wilmington Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

Follow me on Twitter

Have you been thinking of

Have you been thinking of  The word is out across the country that mortgage rates and housing prices are rising. But along with these two important homebuying factors, two others are stronger than ever— homebuyer confidence and demand. Now is the time for

The word is out across the country that mortgage rates and housing prices are rising. But along with these two important homebuying factors, two others are stronger than ever— homebuyer confidence and demand. Now is the time for  It’s getting hotter and hotter outside. That can only mean that it’s time to get your house ready for the summer months. So here are some important tips every

It’s getting hotter and hotter outside. That can only mean that it’s time to get your house ready for the summer months. So here are some important tips every  If you are a

If you are a

According to the National Association of Realtors, 2013 could be the best

According to the National Association of Realtors, 2013 could be the best  There is good news for

There is good news for  Most

Most  A recent article in

A recent article in