5 Delaware and Pennsylvania Pandemic Real Estate Myths— Debunked!

These are uncertain times for everyone, no matter where in the world you live— especially when it comes to real estate. There are Delaware and Pennsylvania real estate rumors floating around about whether it's a good time to buy or sell your home amid a pandemic, and many more, but many of them can be debunked!

As your local real estate experts in Delaware and Pennsylvania we are setting the record straight about buying and selling homes during this time!

Myth: It's a bad time to sell your home

Many homeowners who decided to sell this year have since pulled their homes from the market, mainly due to the fear of showings and others entering their property during this public health event. However, right now, research shows that buyers actually outnumber sellers which means it's better to be a seller in today's market! There is still plenty of demand for Delaware and Pennsylvania real estate, so if you're thinking about moving, you may not want to hold back!

Myth: Home prices are dropping

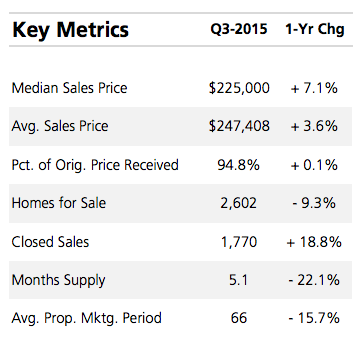

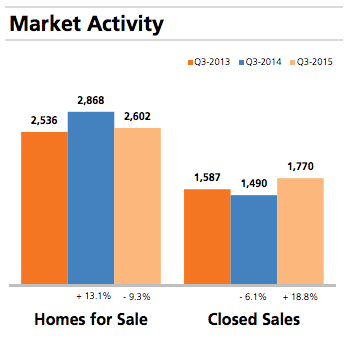

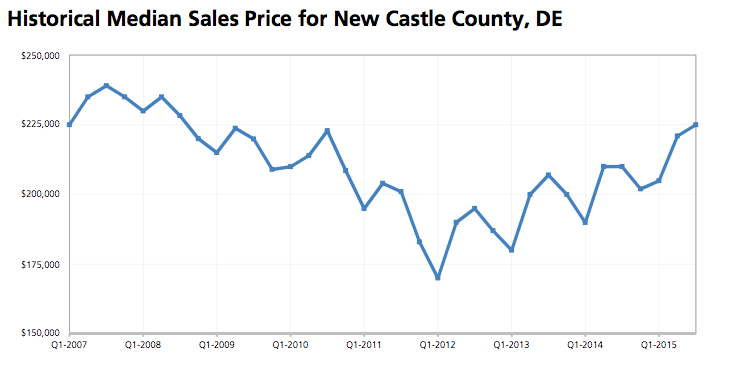

When you look at the data, you'll notice just the opposite— home prices are rising! Mortgage rates are still historically low and prices are currently growing faster than they did pre-COVID.

In fact, according to the NAR, the national median price for single-family homes grew 7.7% during the first quarter of 2020, to $274,600.

Myth: Buyers aren't interested right now

The exact opposite is true! As we mentioned above, there are currently more buyers than sellers in the Delaware and Pennsylvania real estate market— which means you have a great chance of selling your home quickly and for the right price!

According to NAR’s Pending Home Sales Index, pending home sales jumped 44.3% in May, the largest month-over-month increase since the index’s inception in 2001.

Myth: You can't view homes in person

Showings are still very much an option for buyers in Delaware and Pennsylvania, while they may not have been a few months back. Real estate agents take extra precautions to keep their clients safe during this time, so you are able to view homes in person, but if a virtual tour is better for you, that is an option as well!

Myth: Mortgage rates are rocky

As you may have noticed all year, mortgage rates have stayed steadily low! There is no chance of rates skyrocketing right now, so if that is holding you back, take a deep breath. As of July 16, mortgage interest rates dipped below 3% for the first time in 50 years, to 2.98%, according to Freddie Mac.

Have more questions about buying or selling a home in Delaware or Pennsylvania? Contact our experts with the Kat Geralis Home Team today!

We look forward to hearing from you!

Katina Geralis

DE and PA Real Estate Expert

eXp Realty

Homes for Sale

Visit My Website

Contact Me

Find me on Facebook

For

For

In a

In a  As more

As more